Research

Publications

-

Fairlie, R., Fossen, F., Lyu, K. (2026). A Tale of Two Startups: The Loss and Gain of Startups in the U.S. Economy in the Pandemic, Small Business Economics.

-

Lyu, K. (2023). Social Capital and Self-employment Dynamics in China, The Chinese Economy, 56:6, 459-485, 2023.

Working Papers

- Job Market Paper:

How Do Minimum Wages Affect Nonemployer Businesses in the United States?

With Frank Fossen

IZA Discussion Paper No. 18101

Revise & Resubmit at Labour Economics

Presented at 29th SOLE Annual Meeting 2026, GLO-JOPE 2025, Innovations in Data and Methods Applied to Institutions and Entrepreneurship Workshop (UW–La Crosse) 2025✚, WEAI 100th Annual Meeting 2025, 45th BCERC 2025, REGIS Summer School 2024, SEA 94th Annual Meeting 2024, SBEJ 3rd Online Conference 2024, University of Nevada, Reno 2024

Second Prize, Smart Economic Planning and Industrial Policy Conference 2025

✚ coauthor presentation

Abstract:

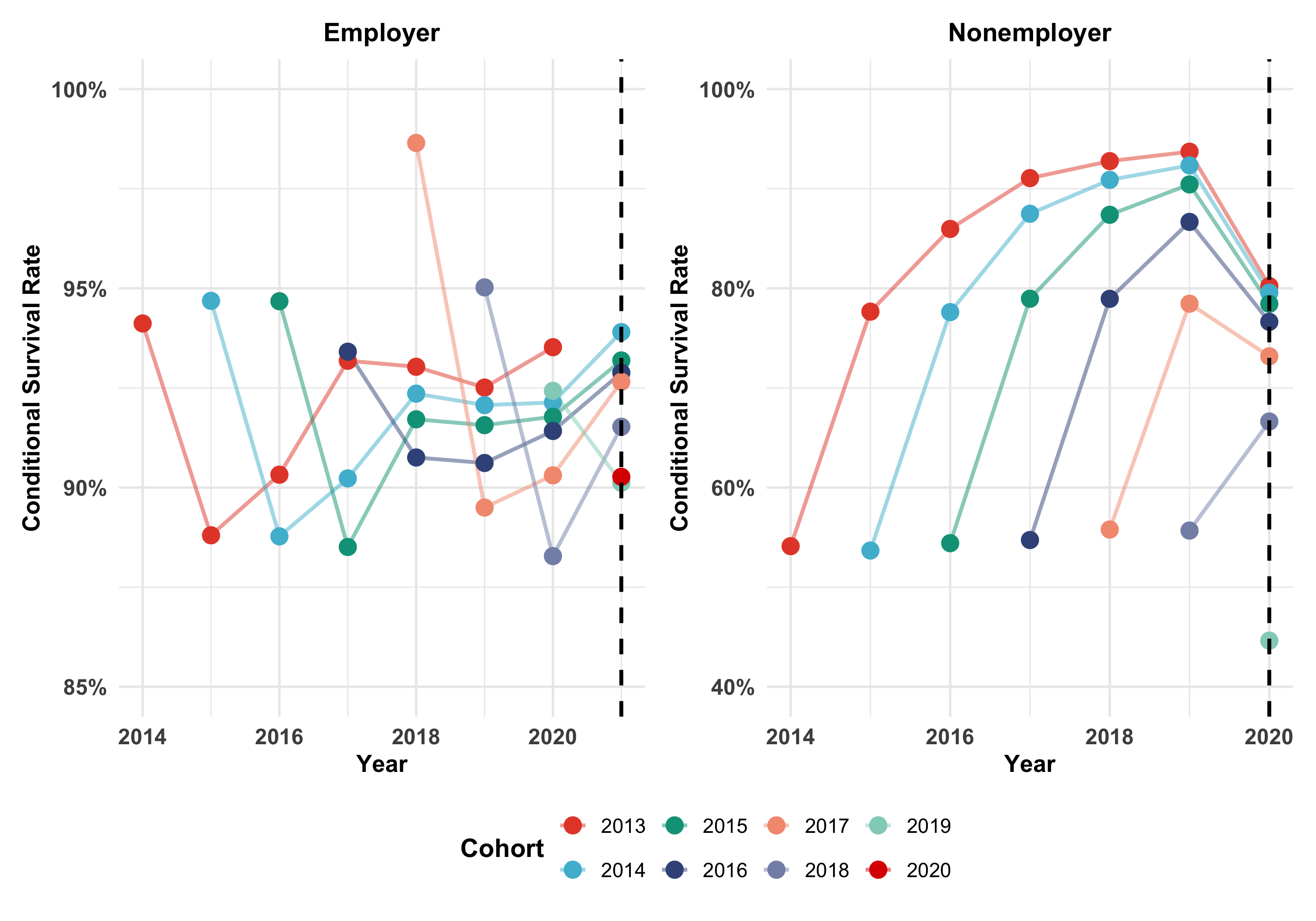

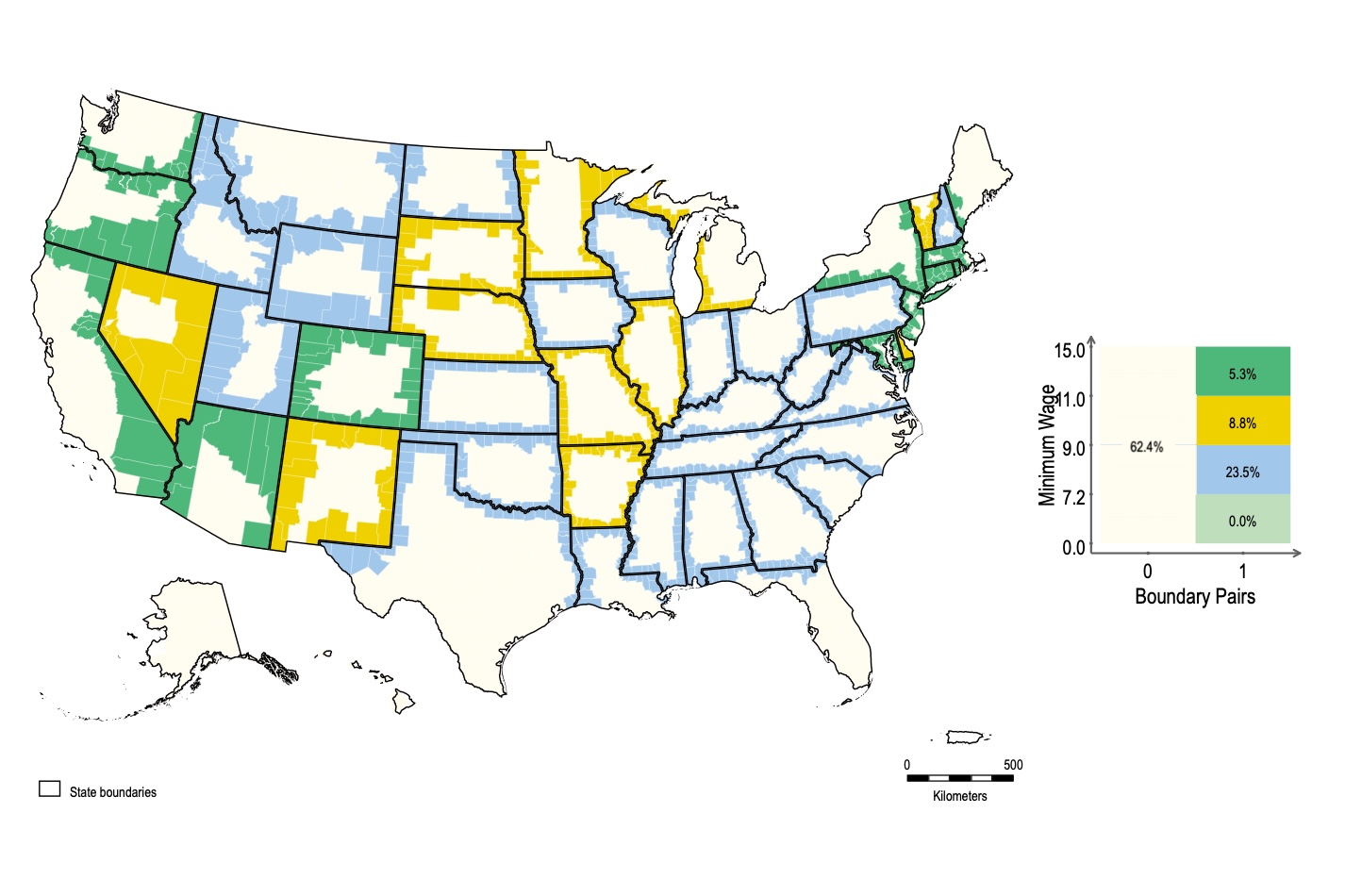

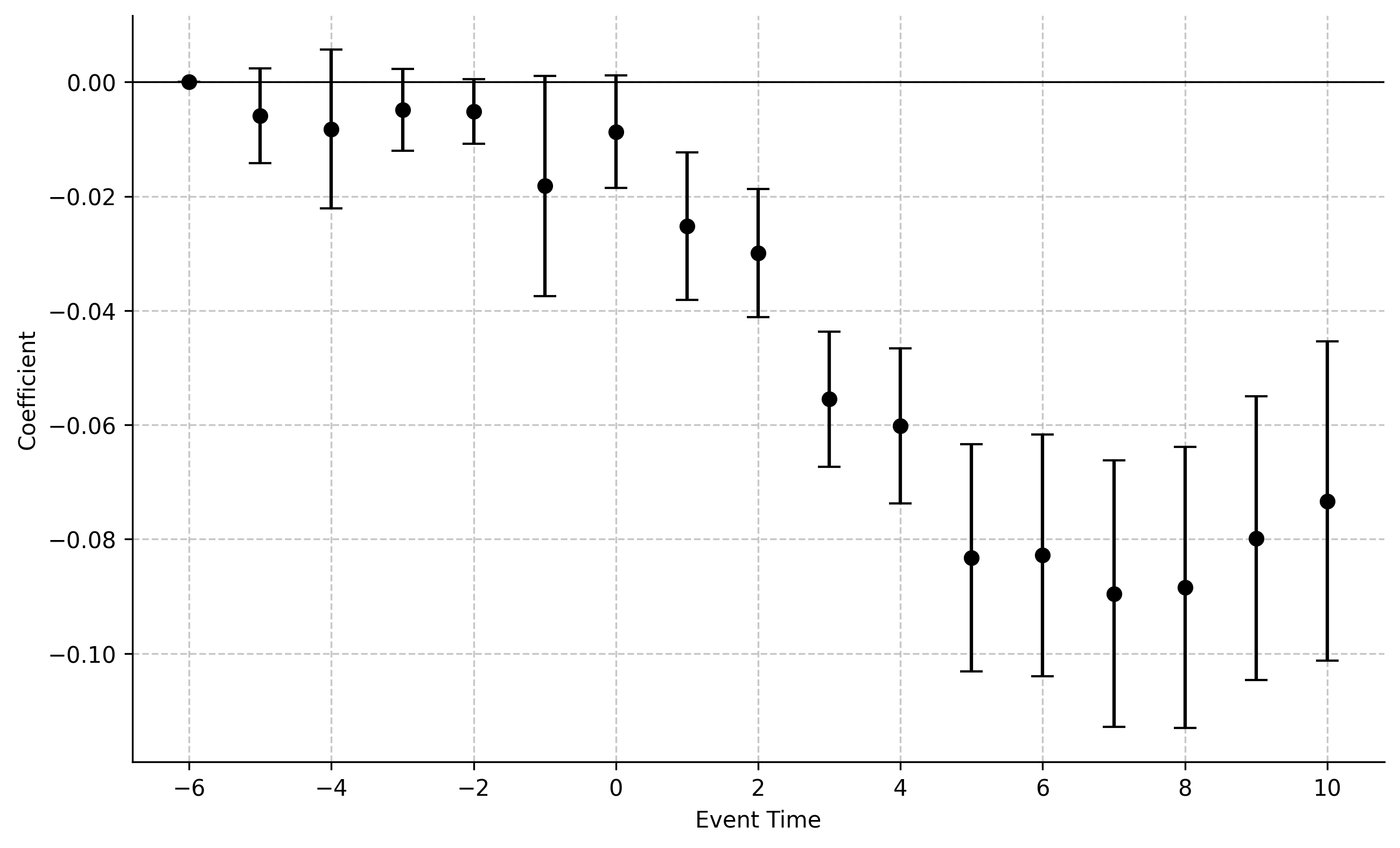

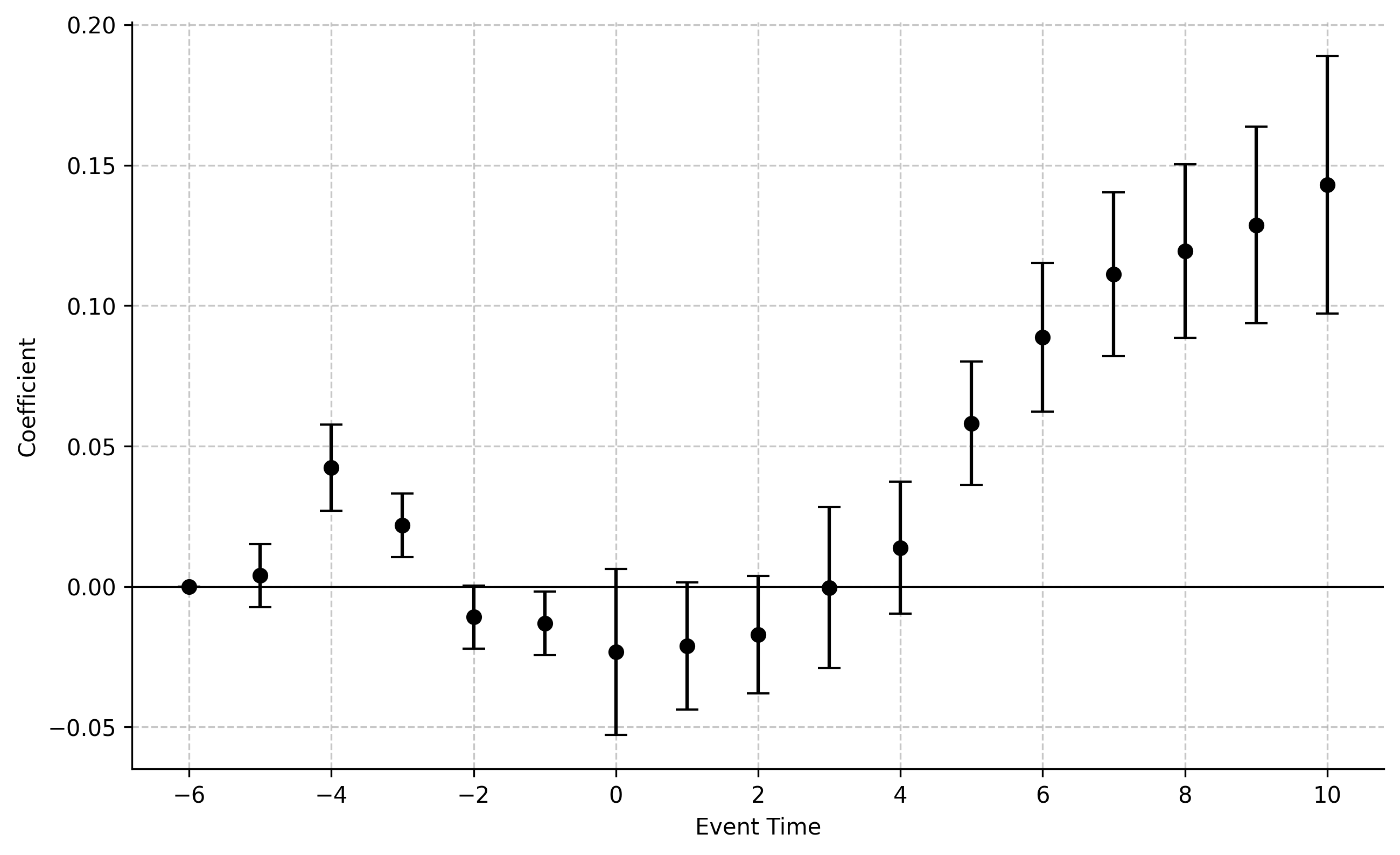

This paper investigates the impact of regional minimum wage increases on nonemployer business establishments in the United States. We develop a theoretical model of occupational choice motivating our empirical analysis. The effects of minimum wages are estimated using panel data analysis and an identification strategy that compares nonemployer establishments in contiguous counties across neighboring states. Our analysis employs data from the Nonemployer Statistics provided by the U.S. Census Bureau, spanning from 2001 to 2020. The findings indicate that a $1 increase in the minimum wage leads to a 0.5%–0.9% decrease in the number of nonemployer businesses, likely due to relatively more attractive wage employment. This shift is smaller in counties characterized by higher percentages of Hispanics, African Americans, Asians, and lower percentages of high school graduates. Conversely, higher minimum wages increase the number of nonemployers in the transportation sector as individuals are pushed into the gig economy, which is not covered by minimum wages. Further analysis based on various data sources from official statistics reveals that higher minimum wages discourage transitions from nonemployer to employer status and instead increase transitions from self-employment to wage employment and unemployment. Our findings add perspective to the debate on minimum wages by showing how this regulation affects nonemployers as an important part of their regional institutional environment.

- Local Credit Supply Shocks Discourage Startups from Loan Applications

With Rachel M. Flanigan and Frank Fossen

Reject & Resubmit at Journal of Banking & Finance

Abstract:

Are entrepreneurs discouraged from applying for bank loans during a credit crunch? We study discouraged borrowing, loan applications, and loan approvals among young firms using the Kauffman Firm Survey, a cohort study of U.S. startups founded in 2004 and followed through the Financial Crisis of 2008–09 until 2012. Using an instrumental-variables approach, we estimate the causal effect of county-level credit supply on young firms’ access to bank loans. The results indicate that a large segment of startups is discouraged from applying for loans following a local credit-supply shock, controlling for the firms’ credit-risk scores. We also document that these adverse effects of credit-supply shocks on the financing of startups are obscured when only loan-application or approval rates are considered.

-

Taxes, Incentives and Entrepreneurship: Evidence from the Universe of U.S. Startups

With Robert Fairlie, Frank Fossen, and Andrew Johnston

Under Review; Presented at NBER Place-Based Policies and Entrepreneurship Conference 2025✚, SEA 2025, NBER Economic Analysis of Business Taxation Workshop 2025✚, 20th EGSC (WashU) 2025; WEFI 2025, 6th SOLE–EALE–AASLE World Labor Conference 2025, 100th WEAI 2025✚, 5th UCLA Anderson Price Research Conference 2025, Goergia State University 2025✚, University of Michigan 2025✚, University of Nevada, Reno 2025

✚ coauthor presentation

Abstract:

Governments spend billions of dollars each year on tax cuts and incentives targeted at businesses, but are these tax policies effective? This study provides the first causal evidence on how a comprehensive set of local taxes and incentives influences startup activity and outcomes. Leveraging new restricted-access administrative panel data on the universe of U.S. startups, we employ difference-in-differences designs exploiting large policy changes. Key findings include: (1) Tax increases significantly reduce startup numbers and employment; tax cuts have nearly symmetric positive effects. (2) Corporate taxes have the most robust impact on startup activity. (3) Enacted incentives stimulate startup formation and reduce exits (notably R&D tax credits); this stimulus is asymmetric, not equally reversed by incentive cuts. We do not find evidence that startups relocate to different states as state policies change, implying responses in total numbers of startups and corresponding broader welfare effects.

-

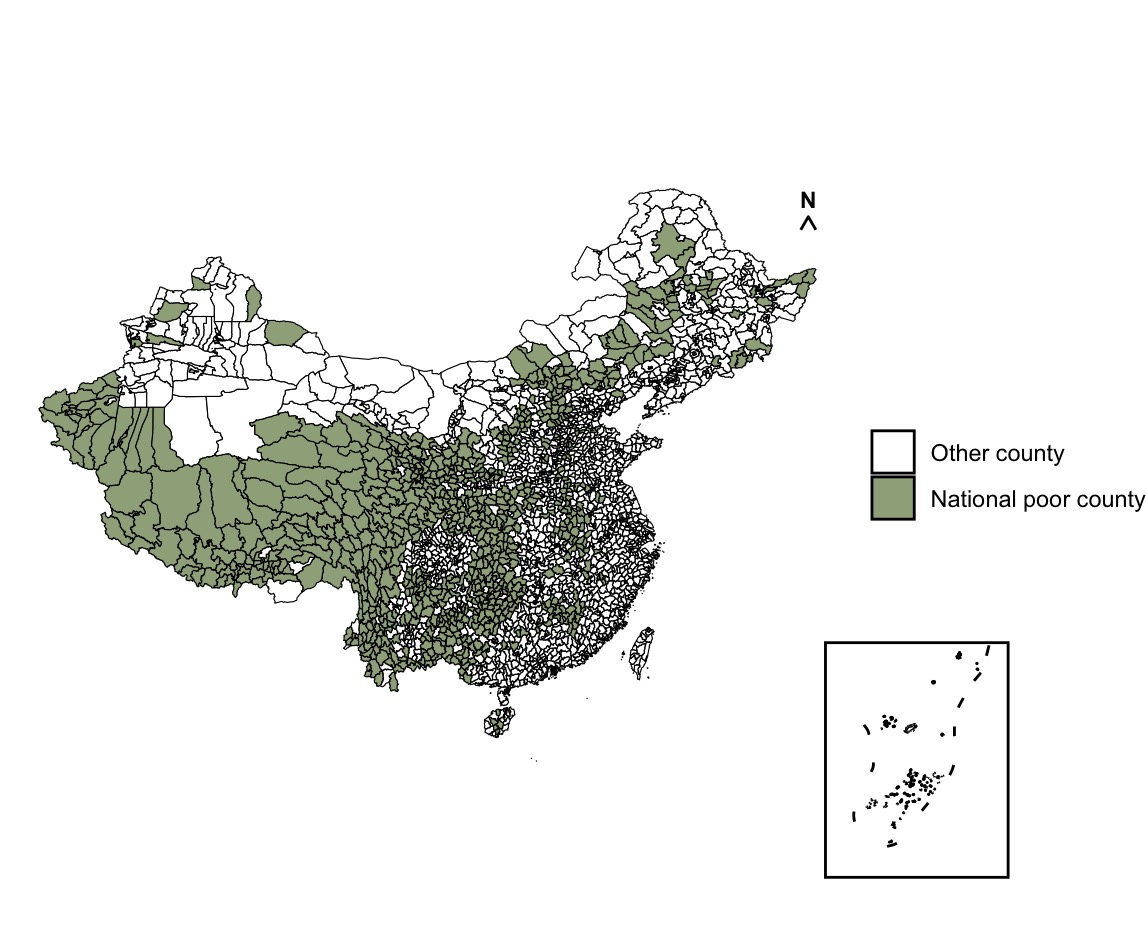

Targeted Poverty Alleviation and Unincorporated Entrepreneurship: Evidence from China

With Shunfeng Song and Mengfei Zhang

Under Review; Presented at 100th WEAI 2025

Abstract:

Unincorporated businesses serve as economic lifelines for low-income households when formal jobs are scarce. This study provides the first causal evidence that a large-scale anti-poverty program can promote unincorporated entrepreneurship. We focus on China’s Targeted Poverty Alleviation program, a landmark initiative combining precision targeting with multi-sector interventions. Using a difference-in-differences approach, we examine county-level business registrations (2010–2022) and household survey data (2010–2020). The program significantly increased unincorporated business entry by 6.9% at the county level and raised household business ownership by 2.75 percentage points. Three mechanisms drive these gains: spillover from large enterprises, expanded access to credit, and infrastructure improvements. Effects concentrate in counties with stable leadership and moderate corruption and are strongest in agriculture and among poor households, showing that well-governed, targeted interventions can redirect business ownership toward disadvantaged groups. Overall, our findings offer lessons for other low- and middle-income economies seeking to empower marginalized populations through small-scale enterprise.

-

The Effect of the Kansas Tax Reform on Self-Employment Hours Worked

With Ege Can, Hieu Pham, and Jingjing Yang

Revise & Resubmit at International Tax and Public Finance

Presented at 117th NTA Annual Conference on Taxation 2024

Abstract:

In 2012, Kansas exempted pass-through business income from the state individual income tax. We examine the reform’s causal effect on entrepreneurial labor supply using a difference-indifferences design with Current Population Survey and American Community Survey microdata. The reform caused an immediate, negative, and statistically significant reduction in weekly hours among the self-employed, with the largest response for the unincorporated. The effect attenuates and does not persist. This outcome contrasts with the reform’s goal of promoting business activity. These findings provide new evidence on the intensive margin impacts of tax policy on entrepreneurship.

-

From Vice to Venture: Evaluating the Impact of Smoking and Drinking on Self-employment in China

Solo-authored paper

Revise & Resubmit at Journal of Entrepreneurship in Emerging Economies

Abstract:

Risky health behaviors, such as smoking and alcohol abuse, not only lead to preventable deaths but also affect workplace performance. Using data from the China Health and Nutrition Survey, this study examines how these behaviors influence the choice between solo self-employment, employer entrepreneurship, and paid employment. The study employs the instrumental variable approach, using cigarette and alcohol prices as instruments. The findings reveal that increased smoking and drinking behaviors reduce the likelihood of choosing self-employment, regardless of its type. Two primary channels of influence emerge from the analysis: the “individual channel,” which indicates that such behaviors adversely affect health and decrease the likelihood of becoming an employer, and the “group addiction channel,” which suggests that these behaviors boost social capital, thereby increasing the chances of business ownership.

Work in Progress

-

AI Exposure and Investor Reactions to the 2025 Trump Tariffs

With Kun Liu, Shaojie Lai, Chaojiang Wu -

Regulating Risk-Taking: Minimum Wages, Unemployment Benefits, and Startup Formation in the United States

With Robert Fairlie, Frank Fossen, Andrew Johnston -

Ultra-Processed Food Exposure and CPI Pass-Through in Colombia

With Grey N. Anderson